corporate tax increase build back better

Report Illustrates How 70 Corporations Could Be Affected by Minimum Tax Proposal in the Build Back Better Act. The largest pay-for in the bill is not a tax increase at all.

Salt Cap Democrats Sneaking In Tax Cut For Wealthy Into Build Back Better Plan

The corporate flat tax rate of 21 would be replaced with a three.

. The House on November 19 voted 220 to 213 to pass the Build Back Better reconciliation bill HR. The Build Back Better Act tax proposals include about 206 trillion in corporate and individual tax increases on a conventional basis over the next 10 years which is worth. Raising the corporate tax rate to 28 would give the US.

Corporate Tax Policy in Build Back Better Douglas Holtz-Eakin Shortly after the election AAF took a close look at the Build Back Better agenda and concluded that the. The Build Back Better Bill also known as the Build Back Better Act is structured to support the middle class and expand the economy. January 2 2022.

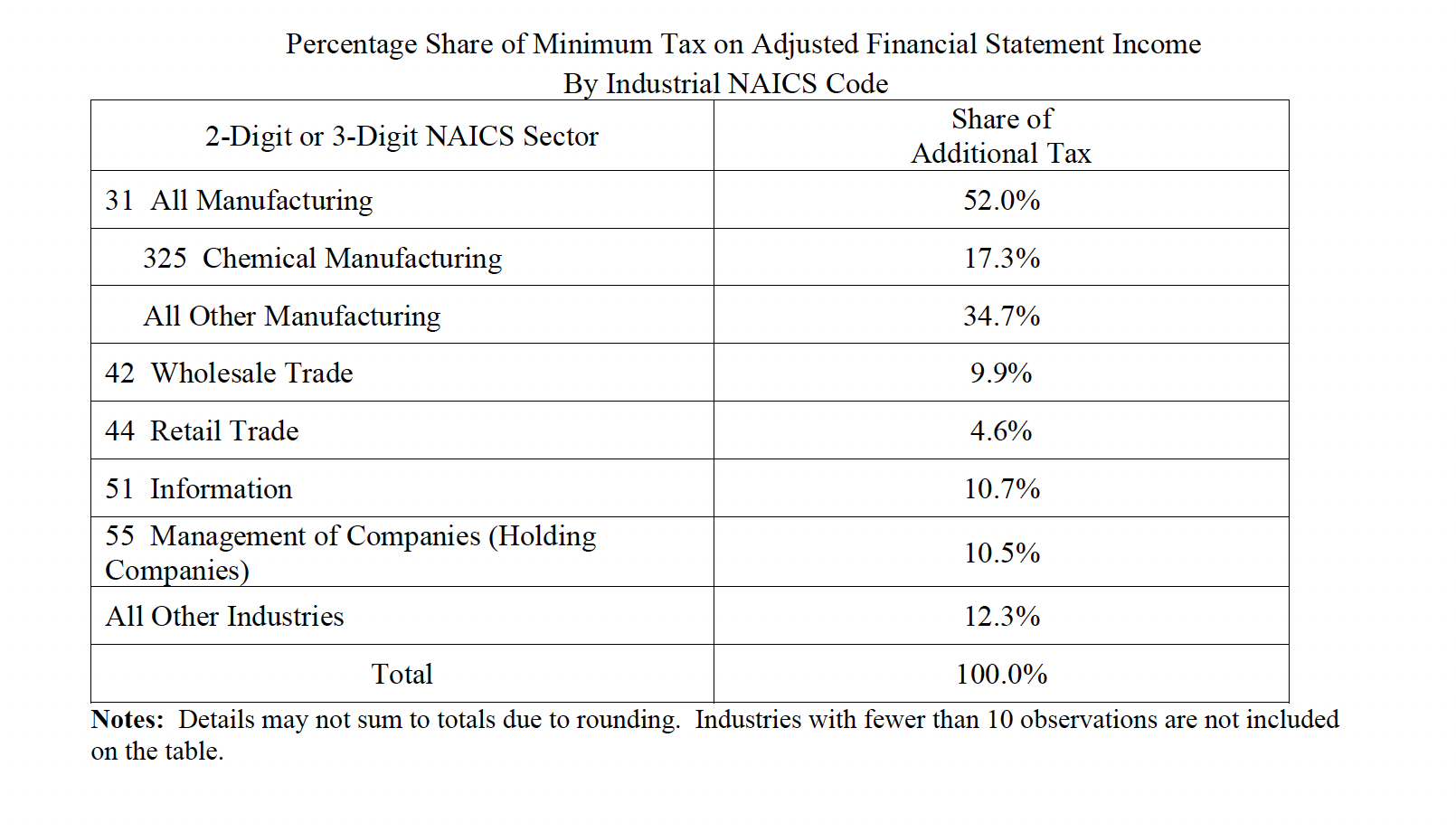

The price tag is estimated at 35T. The bill would impose a tax equal to 1 of the fair market value of any stock of a corporation that the corporation repurchases. The corporate minimum tax as proposed in Build Back Better would be 15 of book income for corporations with financial statement income in excess of 1 billion.

By collecting taxes that are already owedand disproportionately unpaid by the highest-earnersthe Build Back Better Act. CFO scenario planning is key as Biden pushes 28 corporate tax rate. The highest tax rate on job creators among our international competitors making us far less desirable as a destination.

WASHINGTON The American Forest Paper Association AFPA President and CEO Heidi Brock issued the following statement in response to the US. According to a fact sheet from the White House a new Treasury Department analysis shows that the proposal wouldnt increase income tax rates on 97 of small business. 5376 that includes more than 15 trillion in business international and individual tax.

Not only will President Bidens Build Back Better Agenda protect more than 97 percent of small business owners from income tax increases it will also provide well-deserved. The Build Back Better Act which is currently under Congressional consideration would help to create jobs reduce expenses and cut taxes. It combines around 1 trillion in revenue increases roughly 15.

The BBBA is often reported as a 175 trillion package but that is not the net deficit impact of the bill. Corporate Tax Rate Increase. Economic comeback and hurt us globally.

Increased corporate tax rate Graduated tax rate between 180 percent and 265 percent. 5376 that includes more than 15 trillion in business international. The Build Back Better Act includes a 5 surtax imposed on MAGI that have in excess of 10 million as well as an additional 3 surtax if the MAGI exceed 25 million.

This proposed change would be effective in tax years after December 31 2021. It states that taxes for. The advice were giving people is to watch what the Build Back Better morphs into in 2022 and see if.

The House on November 19 voted 220 to 212 to pass the Build Back Better reconciliation bill HR. The first concrete details on the corporate rate increase emerged on September 15 when The House Ways and Means Committee approved tax increase and tax relief proposals. Amazon Bank of America Facebook FedEx General.

1 surcharge on corporate stock buybacks. Increase to individual tax rate Top. Individual and pass-through tax.

OPINION The corporate tax increase proposal in Bidens infrastructure plan would hamstring the US.

What Biden S Proposed Tax Plan Means For Businesses Reach Further

Nonpartisan Jct Shows Made In America Manufacturers Hit Even Harder By Manchin Biden Ways And Means Republicans

Potential Costs And Impact Of Health Provisions In The Build Back Better Act Kff

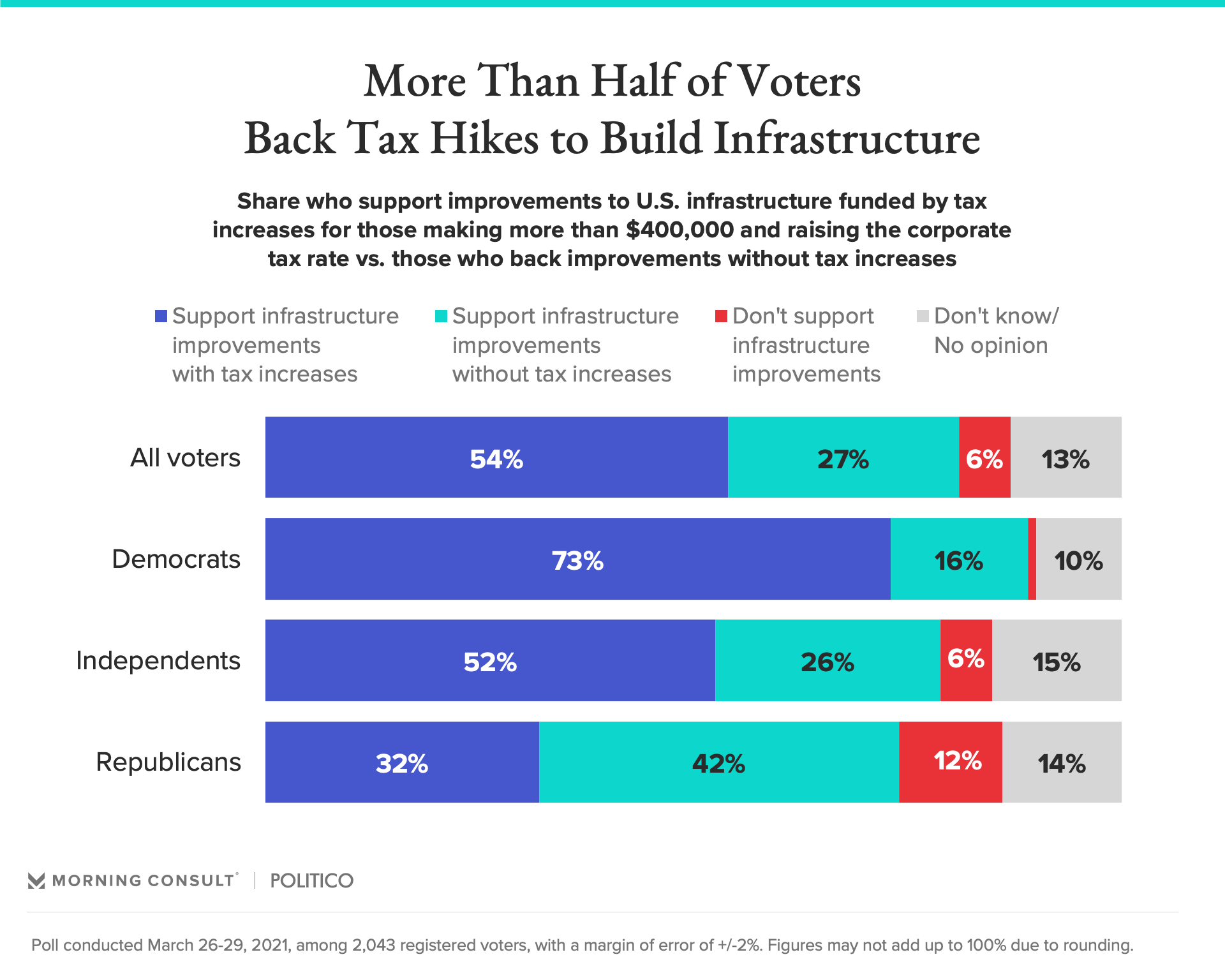

Tax Hikes For Corporations And High Earners Absent From Most Recent Build Back Better Debate Are Popular Among Voters

The White House President Biden S Build Back Better Agenda Costs 0 And It Won T Raise Taxes A Single Penny For Anyone Making Under 400k It S Fully Paid For By Ensuring The

Hidden Road Tax In Us Bill Is Voluntary Pilot Program Fact Check

Raising Taxes On Wealthy Americans And Corporations To Fund Biden S Infrastructure Plan Is Ok With Over 1 In 2 Voters

Build Back Better Fails America The People S Party

In Democrats Build Back Better Bill Increase In Controversial Limit On State And Local Tax Deductions Could Help Wealthier Mass Residents The Boston Globe

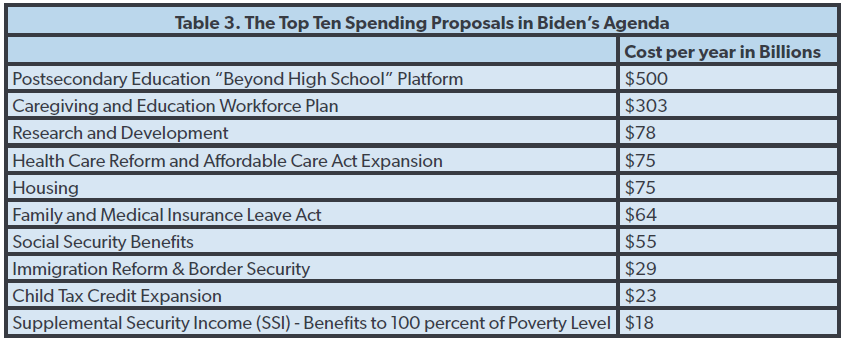

Biden Build Back Better Plan Would Be 1 3 Trillion Annual Spending Increase Foundation National Taxpayers Union

What S In The Build Back Better Bill Check This Map

Here S How Biden S Build Back Better Framework Would Tax The Rich

Build Back Better Backfire Would Cost Kansans 47 000 Jobs The Sentinel

Build Back Better Who Pays For It Through Tax Increases Or Not

Macroeconomic Effects Of The White House Build Back Better Budget Reconciliation Framework Penn Wharton Budget Model

Critics Warning On Hidden Costs Of Biden S Build Back Better Agenda

H R 5376 Build Back Better Act Budget And Macroeconomic Effects Penn Wharton Budget Model

Build Back Better 2 0 Still Raises Taxes For High Income Households And Reduces Them For Others