are funeral expenses tax deductible in california

Individual taxpayers cannot deduct funeral expenses on their tax return. In short these expenses are not eligible to be claimed on a 1040 tax form.

Are Funeral Expenses Tax Deductible Funeralocity

A couple of funeral expenses are not eligible for tax deductions.

. The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Unfortunately funeral expenses are not tax-deductible for individual taxpayers.

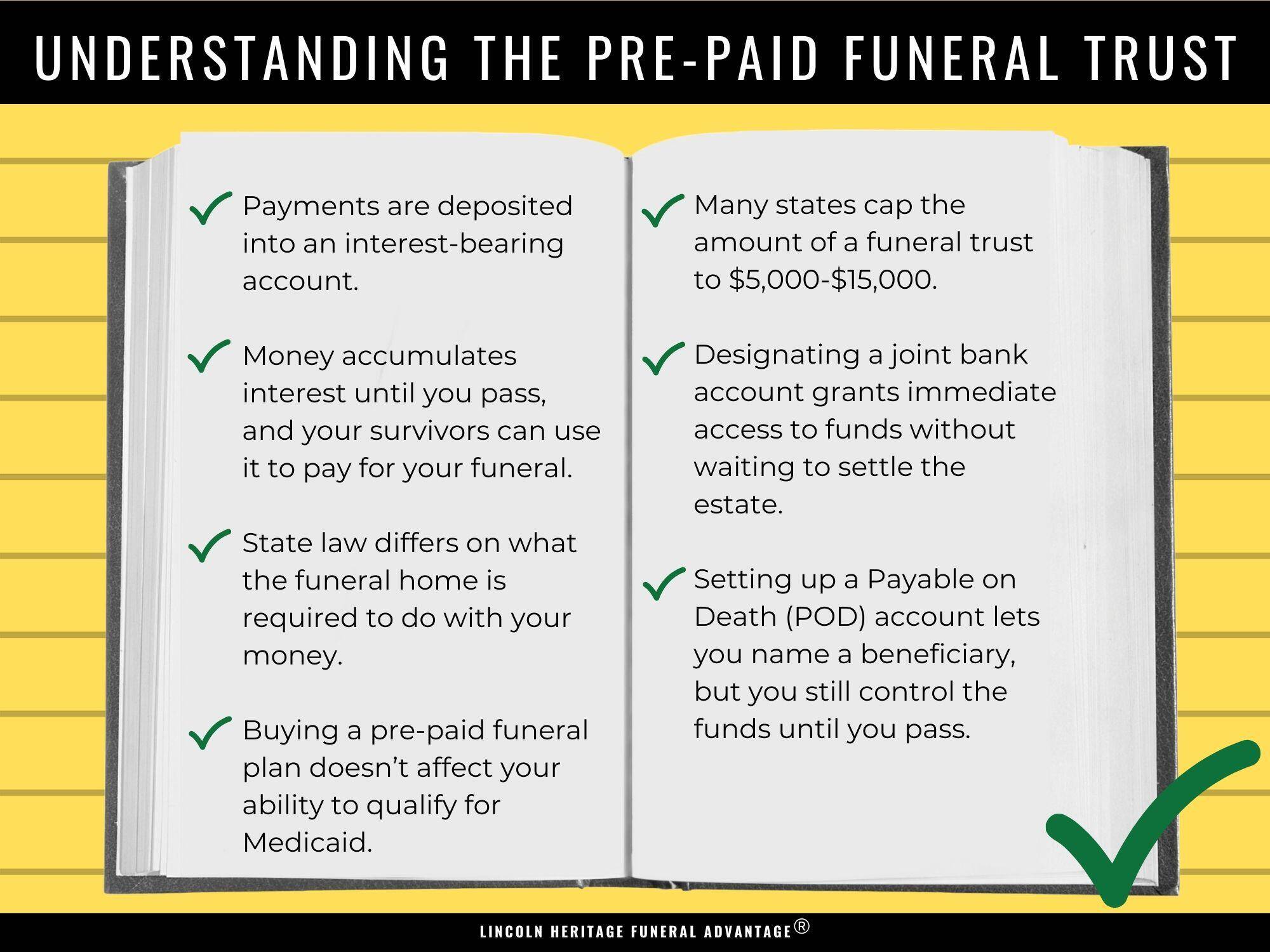

The taxes are not deductible as an individual only as an estate. The estate itself must also be large enough to accrue tax liability in order to claim the deduction. The 1040 tax form is the individual income tax form and funeral costs do not qualify as an individual deduction.

Lets look at the question Are funeral expenses tax-deductible in-depth and. Qualified medical expenses must be used to prevent or treat a medical illness or condition. Its preparation is considered part of a funeral service and under state law funeral services arent taxable.

Deducting funeral expenses as part of an estate. Qualified medical expenses must be used to prevent or treat a medical illness or condition. What is considered a funeral expense.

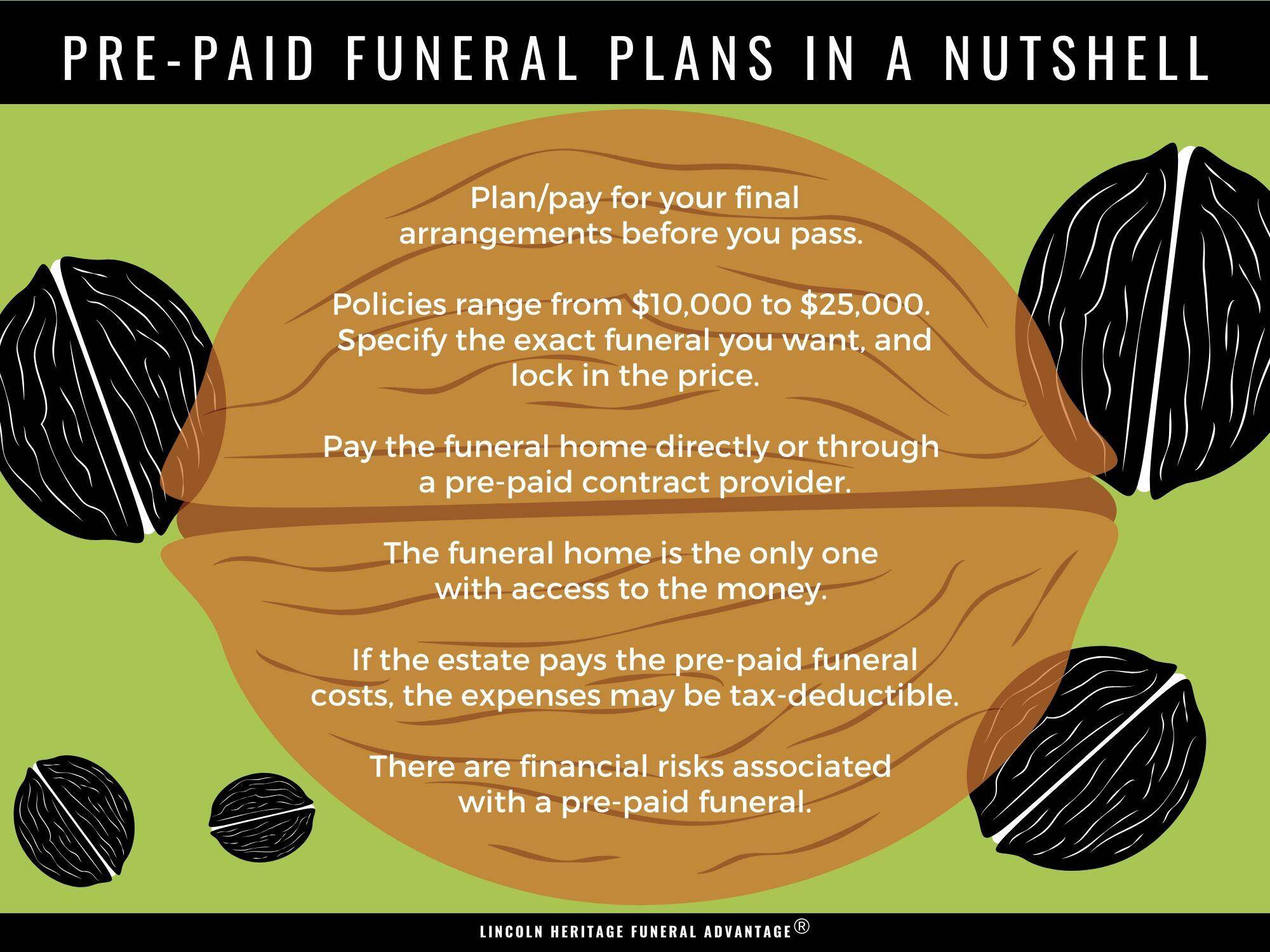

However most estates dont qualify for this deduction unless the estate reaches the threshold of 12060000 the federal estate tax exemption limit in the 2022 tax year. In other words funeral expenses are tax deductible if they are covered by an estate. They are never deductible if they are paid by an individual taxpayer.

The primary rule for claiming funeral expenses as a tax deduction is that the costs must be paid out of a decedents estate. Individual taxpayers cannot deduct funeral expenses on their tax returns. While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs.

However end-of-life expenses are tax-deductible if they exceed 75 of the persons adjusted gross income. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate. While funeral costs paid by friends family or even paid from the deceased individuals account are not deductible from your annual taxes the estate of your loved one can take a deduction on these costs.

465 18 votes Individual taxpayers cannot deduct funeral expenses on their tax return. Alternatively tax deductions do exist for the estate of a deceased individual. The average funeral costs between 7000 and 12000.

The IRS views these as the personal expenses of the family members and other people in attendance and therefore doesnt allow them as deductions. In other words if you die and your heirs pay for the funeral themselves they will not be able to claim any deductions for those expenses on their taxes. In order for funeral expenses to be deductible you would need to have paid for the funeral expenses from the estates funds that you are in charge of settling.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. The IRS allows deductions for medical expenses to prevent or treat a medical illness or condition but not funeral or cremation costs.

Funeral expenses are never deductible for income tax purposes whether theyre paid by an individual or the estate which might also have to file an income tax return. While the IRS allows deductions for medical expenses funeral costs are not included. These are considered to be personal expenses of the family members and attendees and funeral expenses are not deductible on personal income tax returns.

Unfortunately funeral expenses are not tax-deductible for individual taxpayers. This means that you cannot deduct the cost of a funeral from your individual tax returns. Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person.

That being said qualified medical expenses are limited to those performed in an attempt to treat or prevent a medical condition from worsening. This cost is only tax-deductible when paid for by an estate. Individual taxpayers cannot deduct funeral expenses on their tax return.

While individuals cannot deduct funeral expenses eligible estates may be able to claim a deduction if the estate paid these costs. Any travel expenses incurred by family members of the deceased are not deductible. While the IRS allows deductions for medical expenses funeral costs are not included.

If the deceaseds state is taxable then executors are able. Not all estates are large enough to qualify to be taxed. Qualified medical expenses must be used to prevent or treat a medical illness or condition.

Funeral Costs Paid by the Estate Are Tax Deductible. This means that you cannot deduct the cost of a funeral from your individual tax returns. While the IRS allows deductions for medical expenses funeral costs are not included.

As we mentioned funeral expenses arent tax-deductible for most individuals. But extra copies of the death. This means that you cannot deduct the cost of a funeral from your individual tax returns.

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Expenses Tax Deductible

Are Probate Fees And Funeral Expenses Tax Deductible Ez Probate

Are Funeral Expenses Tax Deductible Funeralocity

Are Funeral Expenses Tax Deductible Funeralocity

Tax Deductions For Funeral Expenses Turbotax Tax Tips Videos

Are Funeral Expenses Tax Deductible

These 13 Tax Breaks Can Save You Money Even If You File Last Minute Cnet

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Expenses Tax Deductible

Are Funeral Expenses Tax Deductible Funeralocity

/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide

How To Deduct Medical Expenses On Your Taxes Smartasset

How Prepaid Funeral Plans Work Costs Expenses Pros Cons

Are Funeral Expenses Deductible The Official Blog Of Taxslayer

Can You Claim Funeral Or Burial Expenses As A Tax Deduction For 2019 Cake Blog