pa estate tax exemption 2020

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. Homestead Tax Exemption About The Taxpayer Relief Act.

Recent Changes To Estate Tax Law What S New For 2019

Philadelphia pa 19115 real estate tax relief homestead final deadline to apply for the homestead exemption is december 1 2020.

. The Taxpayer Relief Act provides for property tax reduction allocations to be distributed by. An Act amending Title 51 Military Affairs of the Pennsylvania Consolidated Statutes in disabled veterans real estate tax exemption further providing for duty of. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

The Homestead Exemption reduces the taxable portion of your propertys assessed value. Once we accept your application you never have to reapply for the exemption. The Estate Tax is a tax on your right to transfer property at your death.

If you live in PA and open a non-PA ABLE account you may miss out on important benefits. The lifetime gift tax exemption for gifts made during 2020 is 11580000 increased from 114 million in 2019. Under the new law inheritances from parents to children under the age of 21 will now be taxed at a zero percent rate effectively passing inheritance tax-free.

If your estate exceeds the federal exemption amount you could face a huge liability. Complete Pa Tax Exempt Form 2020-2022 online with US Legal Forms. Federal estate tax exemption.

The federal estate tax has been around in a. No estate will have to pay estate tax from Pennsylvania. For more information about the exemptions and related requirements please review Inheritance Tax Informational Notice 2012-01.

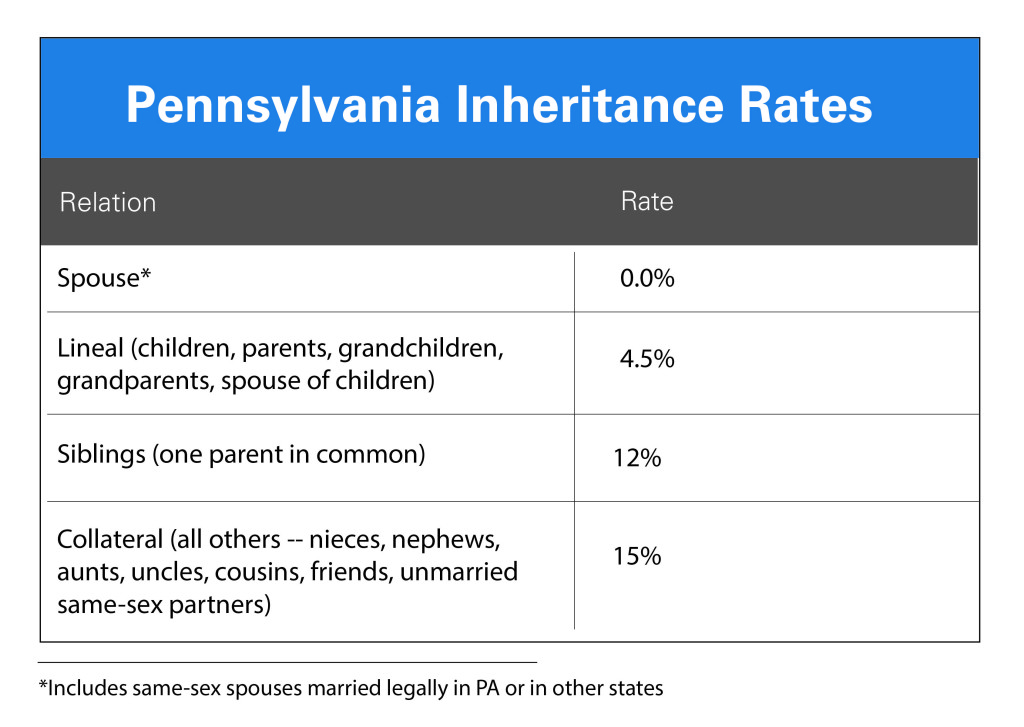

Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is transferred to eligible recipients. Save or instantly send your ready documents. The tax rates start out at zero between husband and wife 45 for lineal descendants your children 12 for consanguinity which are cousins nieces and nephews and 15 for people who are unrelated.

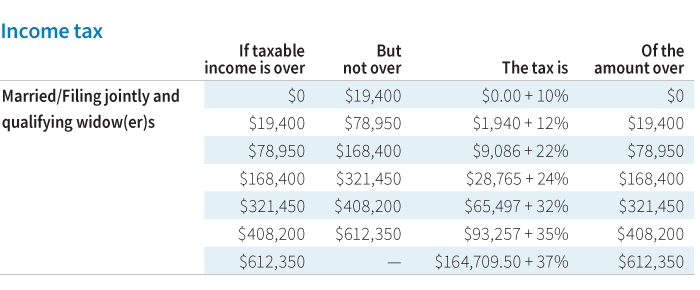

The estate and gift tax exemption is 1158 million per. Complete Pa Tax Exempt Form 2020-2022 online with US Legal Forms. The top marginal rate remains 40 percent.

The Internal Revenue Service announced today the official estate and gift tax limits for 2020. But just because you dont have an issue at the state level does it mean that this cant be a problem at the federal level. If the estate or trusts total PA-taxable interest income is equal to the amount reported on the estate or trusts federal Form 1041 and there are no amounts for Lines.

Generally a person dying between Jan. OK maybe this isnt very simple. The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006.

The Homestead Exemption reduces the taxable portion of your propertys assessed value. For tax years beginning on or after Jan. With this exemption the assessed value of the property is reduced by 45000.

Most homeowners will save 629 a year on their Real Estate Tax bill. Dont put the real estate in an entity such as an LLC Pennsylvania reserves the right to tax an interest in business. People that live in Pennsylvania should know that PA is one of five states that tax individuals on death.

How to Avoid Inheritance Tax in Pennsylvania. Accordingly a shore property in New Jersey will pass free of the PA inheritance tax. Pennsylvania will continue its broad-based property tax relief in 2021-22 based on Special Session Act 1 of 2006.

Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. Federal Estate Tax.

As required by law the Commonwealths Budget Secretary certified on April 15 2021 that 6213 million in state-funded local tax relief will be available in 2021-22. If your estate exceeds the federal exemption amount you could face a huge liability. However Pennsylvania only taxes assets located in Pennsylvania.

Easily fill out PDF blank edit and sign them. The federal estate tax exemption is 1170 million in 2021 and 1206 million in 2022. 31 2020 may be subject to an estate tax with an applicable exclusion amount of 11580000 increased from 114 million in 2019.

Beware of taxes in other states. There is still a federal estate tax. Fortunately Pennsylvania does not have an estate tax.

1 2014 a resident or nonresident estate or trust that distributes Pennsylvania-source income to nonresident beneficiaries must have nonresident withholding calculated and paid by the fiduciary with the filing of the PA-41 Fiduciary Income Tax Return on the Pennsylvania-source income distributed to. Property Tax Reduction Allocations 2021-2022 Fiscal Year. On January 1 2020 a new change to Pennsylvanias Inheritance Tax Law became effective for decedents who pass away as of that date and leave assets to children under the age of twenty-one 21.

FORM TO THE PA DEPARTMENT OF REVENUE. Pa estate tax exemption 2020 Wednesday March 2 2022 Edit. The fair market value of these items is used not necessarily what you paid for them or what their values were when you.

The estate tax exemption for 2020 is 1158 million an increase from 114 million in 2019. This exemption is portable. 1158 million exemption per person an increase of 118000 this is a combined federal gift and estate tax exemption limit.

This form may be used in conjunction with form REV-1715 Exempt Organization Declaration of Sales Tax Exemption when a purchase of 200 or more is made by an organization which is registered with the PA Department of Revenue as an exempt organization.

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

Estate Gift Tax Considerations

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Inheritance Tax What It Is And What You Need To Know

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Here Are The 2020 Estate Tax Rates The Motley Fool

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

7 Simple Ways To Minimize The Pennsylvania Inheritance Tax

The Kiddie Tax Changes Again Putnam Investments

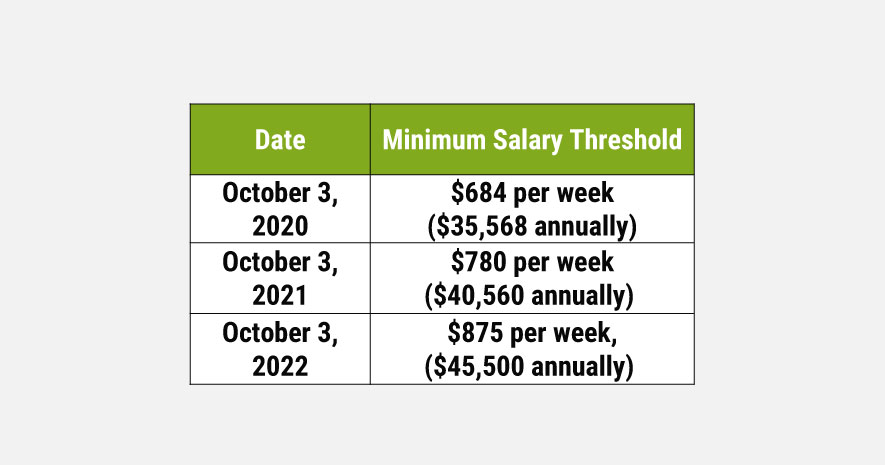

Pa Minimum Salary Required For Exempt Employees Increases

2020 Estate And Gift Taxes Offit Kurman

How Do State Estate And Inheritance Taxes Work Tax Policy Center